marketing

Marketing Budget

Written on 24 October 2021

One thing I did since joining ReferralCandy is to track and monitor our marketing expenses.

I want to have a good understanding of how we are spending on our marketing and how much it costs to get new customers. This allows me to make better decisions on whether we should increase or reduce our marketing investment.

I was lucky to get a glimpse of how this was done at Buffer and want to share how I'm doing this at ReferralCandy now.

Expenses

The first step is to know how much we are spending every month to get new customers and break that down into categories.

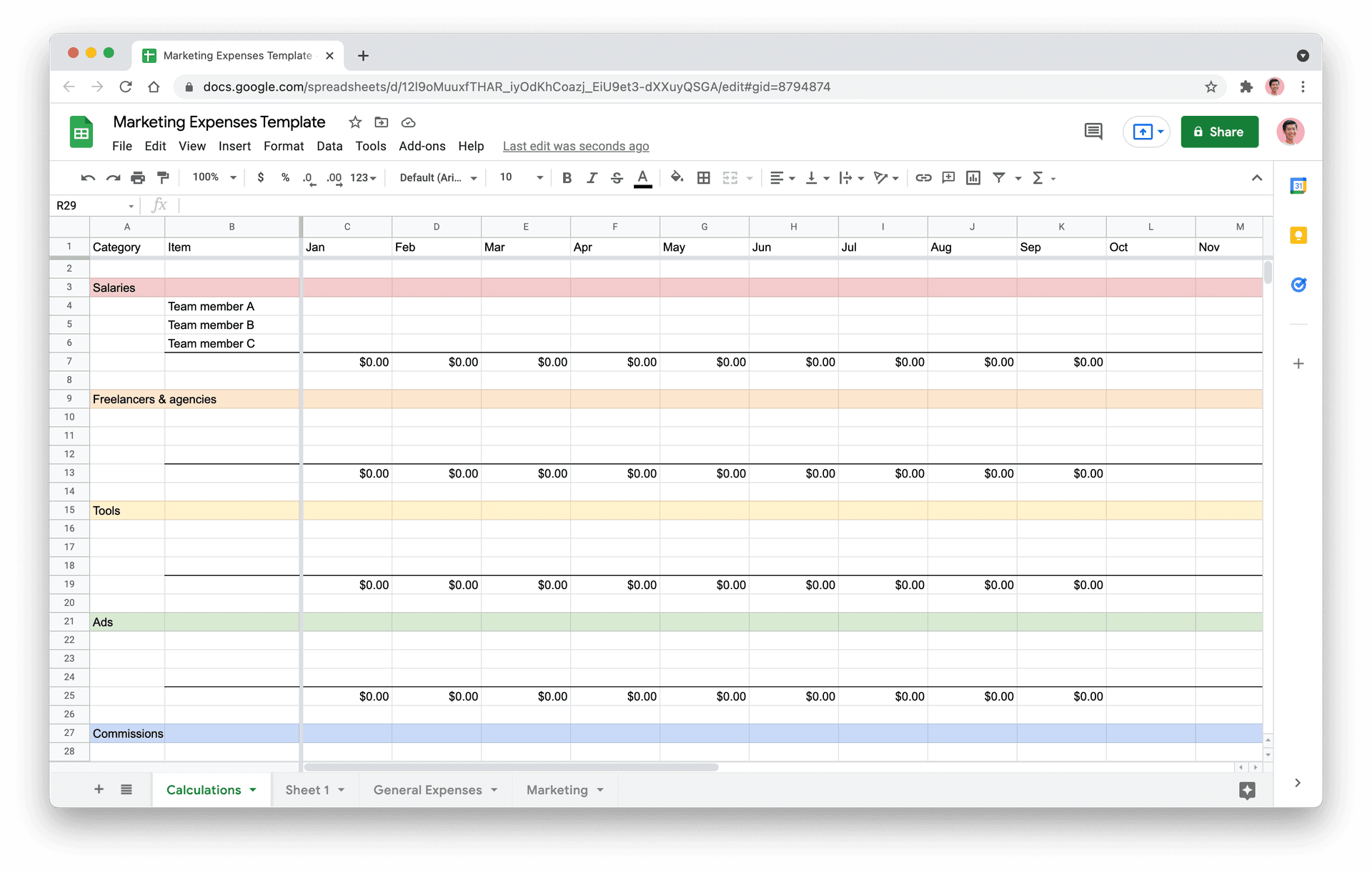

My wonderful finance teammate has been helping me manually pull the expenses from Xero and categorizing them in a spreadsheet.

It looks something like this:

Here are the categories we have:

- Salaries

- Freelancers & agencies

- Tools

- Ads

- Commissions for partners

This isn't the only way to categorize marketing expenses. One alternative I have been thinking about is to categorize the expenses by channels, such as branding, content, and partnerships.

Also, there might be other expenses to consider. At Buffer, we included a portion of our customer support team's salaries because their excellent customer support is a huge reason people recommend Buffer to their friends.

Customer acquisition cost

The second step is to calculate the amount we are spending for each new customer (customer acquisition cost or CAC).

I look at the cost for three segments:

- Signups: People who filled out the signup form

- Trial starts: People who entered their billing details

- Paying customers: People who paid us for the first month

The segments or metrics you look at depends on the goals of your marketing team. If you have a sales team, you likely have a marketing qualified lead (MQL) target. So you would want to calculate the cost of each MQL.

You could go even further by calculating the cost of each new customer by channel. I find that hard to do because customers generally touch more than one of our channels before signing up. The attribution feels a bit of a nightmare to me. (If you know how I could do this easily, please enlighten me!)

Now I know how much we are spending to get each signup, trial start, and paying customer every month. But how do I know whether that is too much or too little?

Lifetime value

The final step is to compare the cost of acquisition with the customer lifetime value (LTV).

There are many ways to calculate LTV. We use a simplified formula of dividing our Average Revenue Per User (ARPU) by our churn rate.

Then I divide the LTV by the cost of acquiring a paying customer to get the LTV:CAC ratio. This ratio tells us how much value (revenue in our case) we are getting for each dollar spent on getting new customers.

Startups generally try to keep the ratio at 3:1. If you have a higher ratio and spare budget, you could increase your marketing investment to acquire more customers (while being mindful of the payback period).

At Buffer and ReferralCandy, we have a pretty high ratio because our main marketing engine has been content marketing, which is more cost-efficient than many other channels such as ads. I'm fortunate to have more budget at ReferralCandy, so we have been experimenting with ads and other channels to see if we could get more customers faster.

Marketing spend

The value of knowing your marketing expenses, CAC, and LTV is that you can calculate how much you should spend on getting each new customer.

For example, if your LTV is $300 and you want to keep your LTV:CAC ratio at 3:1, you should not spend more than $100 per new customer—on average. Some channels like content marketing will be cheaper, so you could afford to spend more on ads as long as the average works out. But if you are spending more than $300 on ads for each customer, you would want to investigate and see if you can lower the cost per customer. Otherwise, you might want to stop that ad.

If you have an affiliate program, you could also use this to calculate the commission to reward.

At a higher level, this can also help you think through hiring decisions, such as how many new team members to hire and what the budget is.