marketing

Customer Acquisition Cost Math

Written on 05 September 2021

For a startup to survive, its cost of acquiring a customer (CAC) should be lower than the lifetime value of the customer (LTV).

Ideally, you want your customers to pay you at least three times more than what you spend to acquire them (LTV:CAC > 3:1). If the ratio is greater than three, you could afford to spend more to acquire each customer, such as paying more for ads.

And if your LTV:CAC ratio is healthy, you could scale up your customer acquisition and get more customers profitably by spending more.

Or at least, that is the simplified model in my mind.

As I get more involved in our marketing budget and expenses, I realized there are more factors to consider.

Payback period

The first is the amount of time it takes to recover the cost of acquiring the customers, the payback period.

For SaaS companies, customers pay on a monthly or annual basis. For example, ReferralCandy customers pay us $49 per month. (For simplicity, I removed the percentage fee.) Even if the lifetime value of our customers is $1,000, we only collect $49 per month from them.

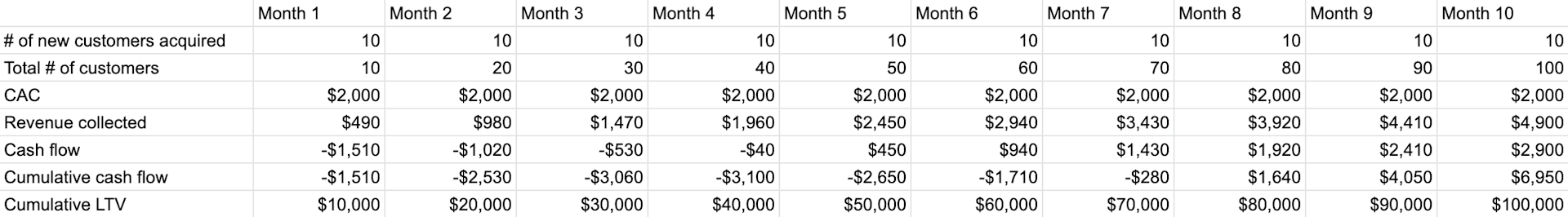

Assuming it costs us $200 to acquire each customer, it will take us about four months to recover the cost (which is considered quite fast). But we are also spending every month to acquire more customers, and the cost adds up.

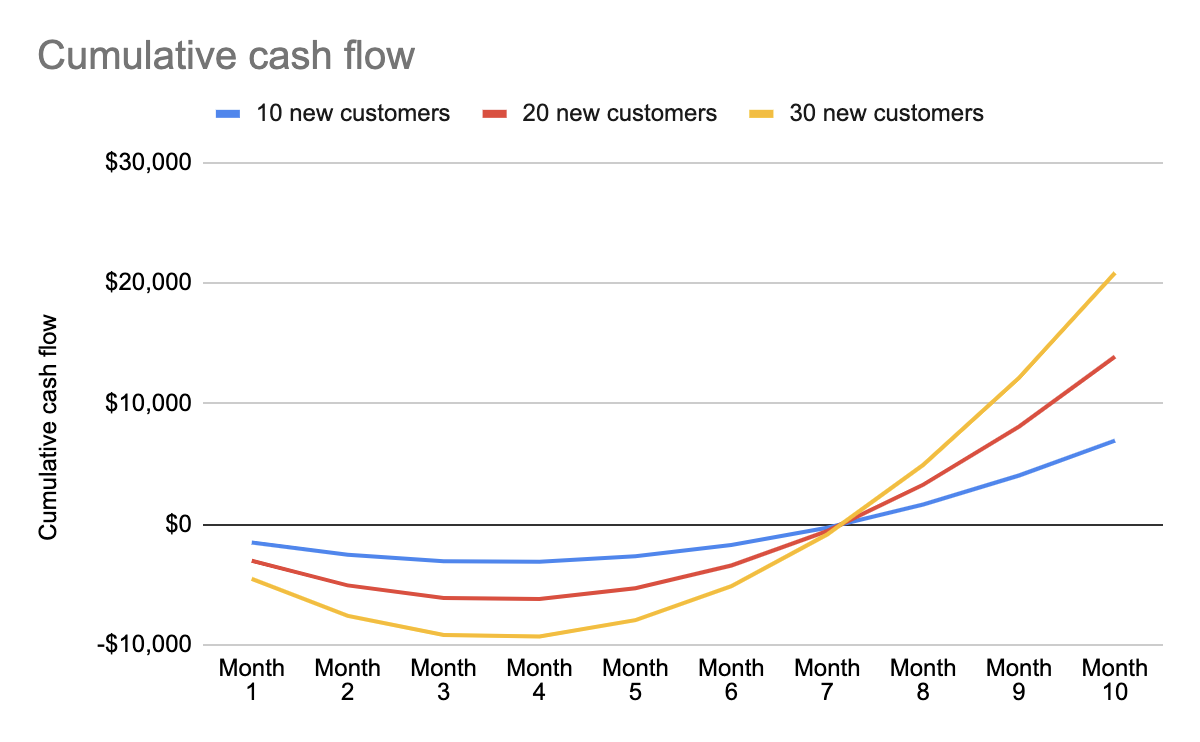

If we acquire 10 new customers every month, we will have a maximum negative cash flow of $3,100 before the cash flow gets better. The cash flow only turns positive in Month 8.

If we scale it to 20 or 30 new customers per month, the maximum negative cash flow will be even greater ($6,200 and $9,300 respectively).

(You can check out my spreadsheet here.)

Furthermore, we most likely would not acquire new customers the moment we spend the money. It could take months or even years for the spend to bear fruits.

Without factoring in the payback period, startups can run into troubles with their cash flow.

An exception is if the startup is funded and can afford losses in the short term for more gains in the future.

Diminishing marginal return

Another factor to consider when scaling customer acquisition is the diminishing marginal return nature of all customer acquisition channels.

The more we spend on ads, the more customers we can acquire—until some point. As we increase our ad spend, the number of customers we acquire per unit of ad spend will decrease. For example, our first $1,000 could bring in five customers while our tenth $1,000 might bring in only one. That could be because all of our potential customers on the platforms we advertise would have seen our ads. Or we have already acquired the people who are most receptive to our ads.

We are still acquiring more customers by spending on ads but fewer per $1,000 ad spend. We can know we have reached the point of diminishing marginal return when the acquisition cost for ads is increasing. At this point, we might want to evaluate if $1,000 spent on another channel could bring in more customers than another $1,000 spent on ads.

In theory, we should know the customer acquisition cost per channel to make the comparison. But in reality, customers are influenced by more than one channel, so it's never so clearcut. One potential option is to always allocate 10-20% of our budget to new channels. When it is obvious that the new channel is helping to lower the overall customer acquisition cost, we could invest more into it, move it into the 80-90% budget, and explore another channel.

Complex reality

While the LTV:CAC ratio provides a simple rule of thumb for thinking about marketing spend and scaling customer acquisition, there are other factors to consider.

If we are not mindful of the payback period, we could run out of money before we collect enough money from our customers. Also, no channel scales indefinitely. Instead of simply spending more on the same channels, we should know when to invest in another channel.